EUR/USD & USD/JPY FORECAST:

- EUR/USD and USD/JPY will be very sensitive to the upcoming U.S. nonfarm payrolls report

- Market expectations suggest the U.S. economy created 200,000 jobs in July

- A strong headline print is likely to boost the U.S. dollar, weighing on the euro and the Japanese yen

Recommended by Diego Colman

Get Your Free USD Forecast

Read More: US Jobs Report Preview: NFP Data to Shape Gold, US Dollar, and S&P 500’s Outlook

The U.S. Bureau of Labor Statistics will release its July nonfarm payrolls (NFP) report Friday morning. Based on Wall Street surveys, a notable 200,000 workers were hired last month at the national level, following the addition of 209,000 jobs in June. In this context, the unemployment rate is projected to remain unchanged at an impressive low of 3.6%, reaffirming the prevailing tightness in the labor market.

Over the past year, economists have consistently misjudged the resilience of the economy, leading to repeated underestimation of employment gains. Given this pattern and forecast bias, it is not unreasonable to believe that the NFP figures could again surprise to the upside. This belief is further supported by low initial jobless claims, which have stayed particularly depressed for much of 2023.

The upcoming report’s strength or weakness compared to expectations will play a crucial role in determining the trajectory of the U.S. dollar, shaping the outlook for both EUR/USD and USD/JPY. Therefore, traders should stay laser-focused on the calendar to adapt their strategies and make more informed trading decisions in rapid-moving markets.

UPCOMING US ECONOMIC DATA

Source: DailyFX Economic Calendar

Empower your trades with expert analysis. Download your free USD/JPY outlook by clicking the link below

Recommended by Diego Colman

Get Your Free JPY Forecast

In its most recent meeting, the Fed embraced a data-dependent approach when making future decisions and evaluating the broader normalization outlook. This flexible guidance has diminished the probability of further policy firming in 2023, but changes in the macroeconomic landscape could prompt a reassessment of the current tightening roadmap.

For example, if job growth exceeds estimates by a wide margin, interest rate expectations may shift in a more hawkish direction, with traders discounting another quarter-point hike in the fall for fear that robust hiring during tight labor market conditions could drive up wages and exert upward pressure on inflation. That said, any NFP reading above 300,000 would likely bolster the U.S. dollar, weighing on EUR/USD but providing support to USD/JPY.

On the other hand, weak employment gains may trigger the opposite outcome. For instance, a soft report could raise concerns about the state of the economy, setting the stage for lower yields and a weaker U.S. dollar. An NFP figure below 100,000 could make this scenario more likely.

Download your free EUR/USD quarterly trading forecast to stay ahead of markets and seize opportunities

Recommended by Diego Colman

Get Your Free EUR Forecast

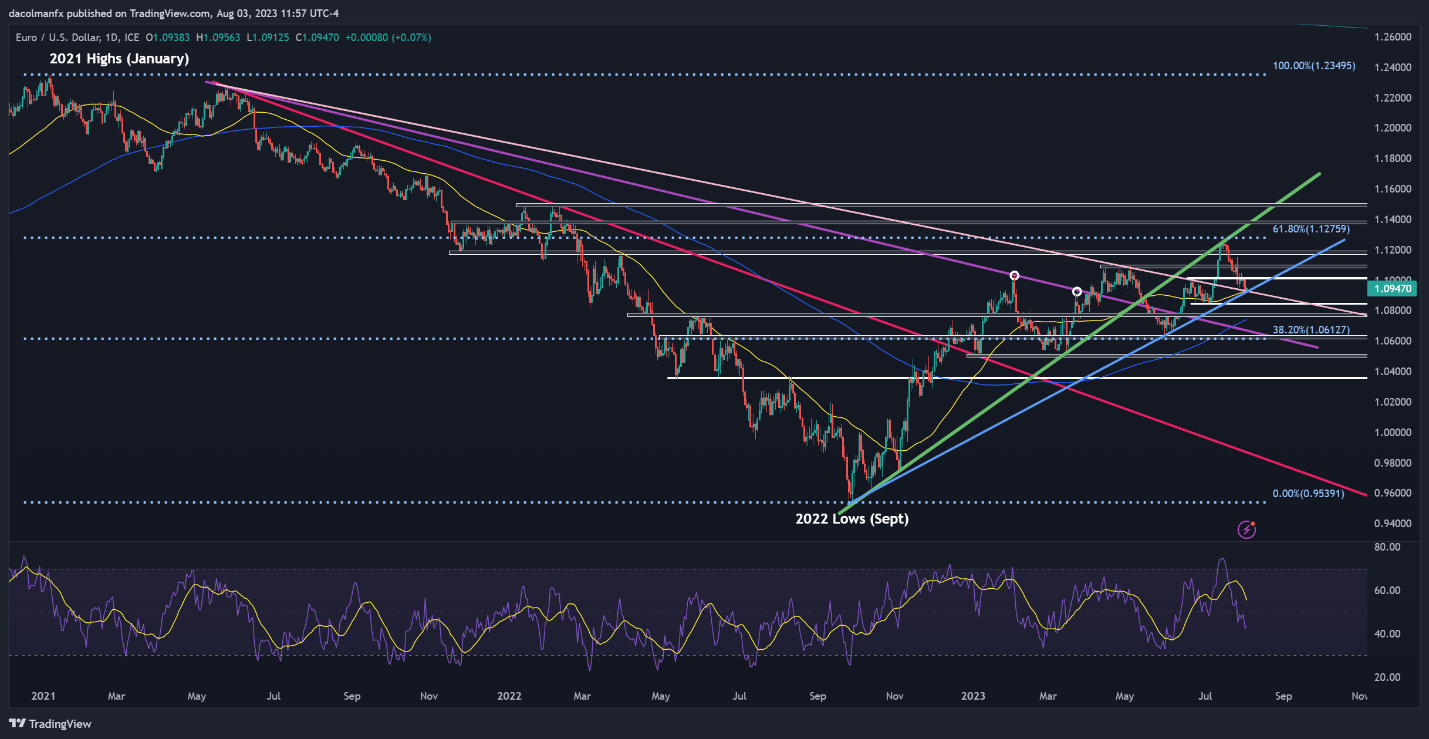

EUR/USD TECHNICAL ANALYSIS

After the recent downward correction, EUR/USD is sitting slightly above trendline support and its 50-day simple moving average, near 1.0925. If the bears manage to push prices below this region, we could see a drop toward 1.0840, followed by a possible retest of 1.0775.

On the flip side, if the pair rebounds from current levels, initial resistance appears at 1.1015, and 1.1100 thereafter. On further strength, we could see a rally towards 1.1175.

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

Recommended by Diego Colman

How to Trade USD/JPY

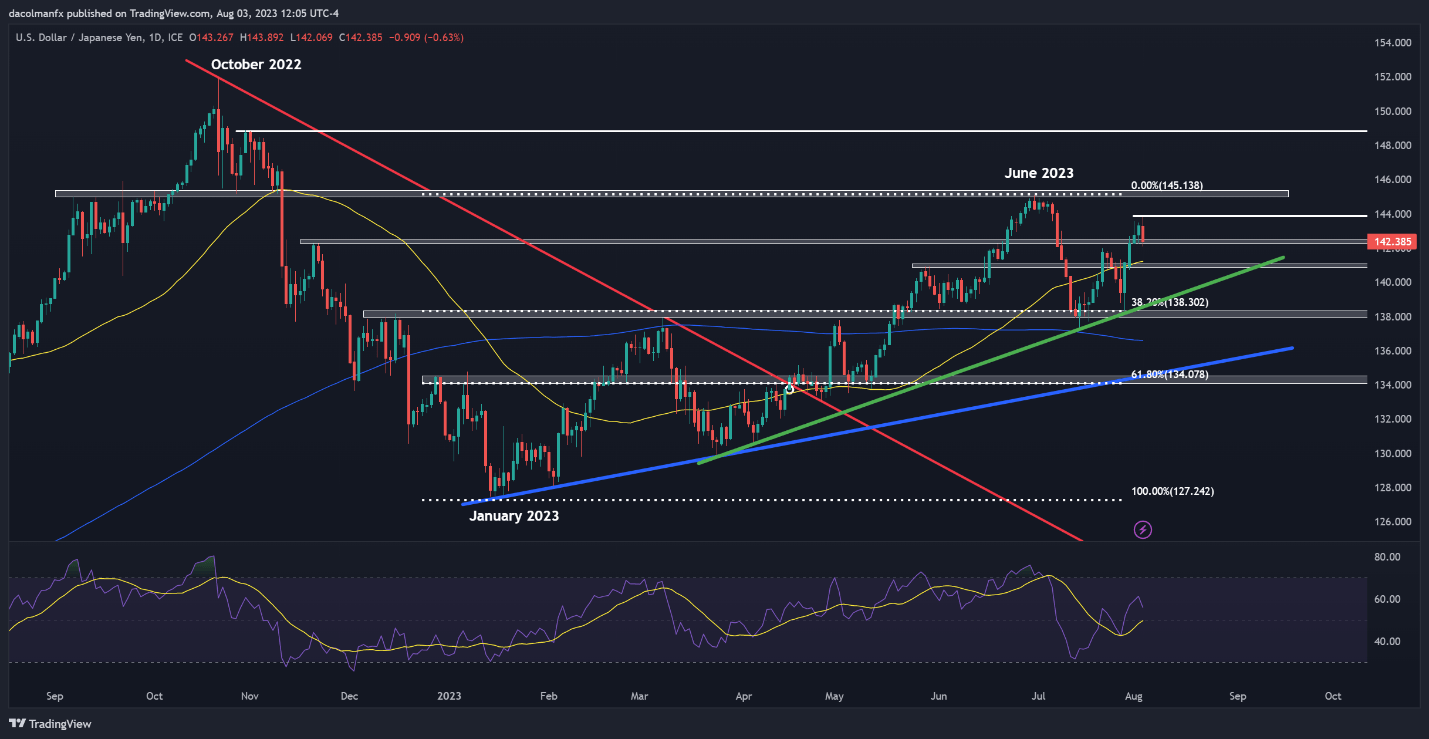

USD/JPY TECHNICAL ANALYSIS

After Thursday’s pullback, USD/JPY appears to be approaching technical support at 142.40. If this floor is breached, sellers could become emboldened to initiate an assault on 141.00. On the flip side, if buyers regain control of the market and trigger a turnaround, initial resistance is located at 143.90, followed by 145.14. In the event of a bullish breakout, upward momentum could gather pace, paving the way for an advance toward 148.85.

USD/JPY TECHNICAL CHART