Even if the U.S. avoids a recession in 2023, American consumers and investors could face a grinding slowdown that likely won’t let up until 2024, according to a new outlook published by Moody’s Analytics chief economist Mark Zandi.

Zandi even coined a new term to describe this kind of protracted downturn, calling it a “slowcession” in a note sent to clients and reporters on Tuesday.

The mainstream view on Wall Street is that as the Federal Reserve slashes interest rates to help cushion the blow for investors and consumers, the U.S. economy will likely enter a brief recession during the first half of 2023, but that it will be over long before year’s end.

Still, while Zandi believes the Fed’s most aggressive interest-rate hikes in decades will have a deleterious impact on GDP growth, he thinks a strong U.S. labor market and other factors relating to the consumer should help prevent an outright contraction in the economy.

“There is no doubt the economy will struggle in the coming year as the Fed works to rein in the high inflation, but the baseline outlook holds that the Fed will be able to accomplish this without precipitating a recession,” Zandi said in the note.

According to a set of forecasts, Zandi expects U.S. gross domestic product to grow by roughly 1% or less on a year-over-year basis during all four quarters in 2023.

Zandi isn’t alone in his view that the U.S. economy will evade a recession this year. Goldman Sachs Group

GS,

chief economist Jan Hatzius has a similar outlook, as do other high-profile names on Wall Street.

What differentiates Zandi’s view is that he expects a significant amount of economic pain but believes it will arrive over a longer period, making it slightly easier for consumers and investors to cope, according to his note.

Fundamental to this outlook is the notion that the Fed will be able to back off its interest-rate hikes before it hammers the economy with another “policy mistake” like the one some believe it made when it delayed raising interest rates until 2022 based on the view that inflation was “transitory.”

While a recession is typically seen as two consecutive quarters of economic contraction, the National Bureau of Economic Research will have the final say in declaring when a recession officially began— and when it officially ends.

Even if the U.S. economy avoids a punishing, jobs-destroying meltdown, Americans could still feel the sting from falling asset and home prices, Zandi added.

Moody’s expects economic growth to bottom out at 0.8% in the third quarter of this year. Zandi and his team don’t expect the rate of GDP growth to exceed 2% until the third quarter of 2024.

What’s a ‘slowcession’?

Economists see roughly 65% odds that the U.S. economy will slide into a recession this year, according to the median forecast from a Wall Street Journal survey.

While Zandi disagrees with this outlook, he acknowledged that the biggest risk with such a high level of conviction is that a recession becomes a “self-fulfilling prophecy” as consumers and businesses curb spending in order to shore up their savings as they brace for bumpy times ahead.

MOODY’S ANALYTICS

Already, signs of a darkening outlook abound, from falling prices of commodities like oil to the Conference Board’s leading indicators index, which takes into account factors like the Treasury yield curve.

But there are also plenty of signs that the economic outlook isn’t as dire as all that. Inflation data released over the past few months show price pressures have already started to recede.

This means that the Fed’s monetary policy has “nearly caught up with current economic and financial market conditions. The reaction function suggests the funds rate should be close to 5%, consistent with investors’ current expectations of the terminal funds rate,” Zandi said.

U.S. financial system is in good shape

Ordinarily, both the state of the U.S. economy and the financial system look far more precarious in the months before a recession begins, Zandi said. But that’s not happening this time around — at least not to the degree that preceded prior downturns.

“Typically, prior to recessions, the economy is plagued by significant imbalances such as overleveraged households and businesses, speculative asset markets, an undercapitalized financial system that has extended too much,” he said.

“For the most part, none of these imbalances exist today,” he added.

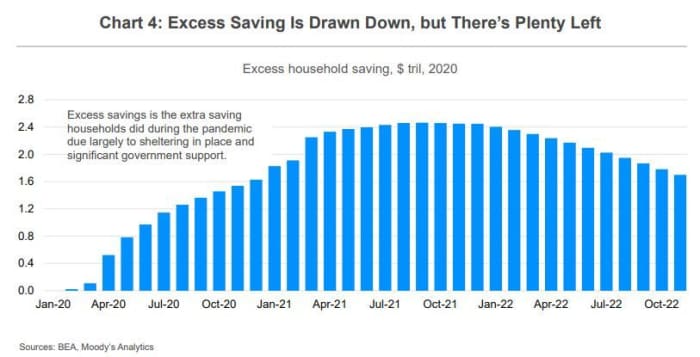

Consumers have ample savings despite drawdown

Economists have been paying close attention to consumers’ bank accounts, and while some have raised concerns about dwindling savings, Zandi believes American families likely won’t have any trouble paying down their debts and keeping up with spending as interest rates rise.

“Most households have also done a good job managing their debts. The share of their incomes going toward principal and interest payments is near a record low, and for the most part these payments will not increase with the higher interest rates,” he said.

MOODY’S ANALYTICS

What’s more, Zandi believes that even though home prices continue to sink as the pandemic-era home-buying boom fades, a shortage of homes resulting from more than a decade of limited construction will help protect home values.

Banks have been vulnerable in the past, but they too are well-capitalized enough to withstand a severe downturn. Instead, credit growth remains “just right,” Zandi said.

“There is neither too much credit (like before the financial crisis when lenders gave loans to households and businesses that could not reasonably pay them back) nor too little credit (like after the crisis when even creditworthy borrowers could not get loans in that credit crunch),” he said.

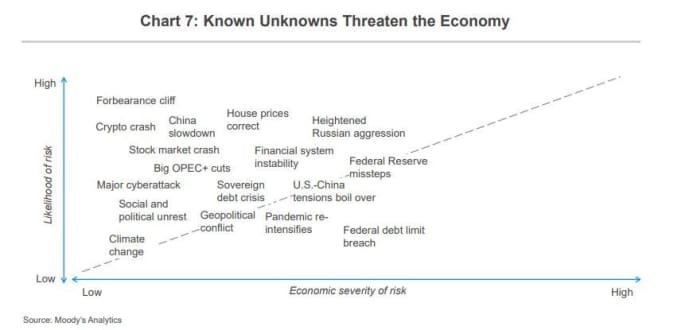

‘Known unknowns’ are a risk

Risks for the U.S. economy abound, Zandi pointed out toward the end of his analysis. While there’s a chance that some new complicating factor could arise out of nowhere, some of the biggest risks are what Zandi described as “known unknowns.”

Also read: One-third of world economy expected to be in recession in 2023, says IMF chief

Examples include an escalation of the conflict in Ukraine by Russian President Vladimir Putin, or the emergence of a disruptive new COVID-19 variant in China. What’s more, financial fault lines abound in the U.S., including the possibility that weakening corporate earnings force investors to further mark down the price of equities.

Zandi provided other examples of “known unknowns” in the chart below.

MOODY’S ANALYTICS

In terms of severity, Zandi fears that a “partisan showdown over the Treasury debt limit, which will need to be raised again by fall 2023,” could have the most destabilizing impact.

Wall Street economists generally expect that a recession will begin before the second half of the year. But plenty of debate remains about the depth and duration of the downturn, as MarketWatch’s Isabel Wang reported.