Trading like a nomad: An introduction

For those who don’t know what Nomad is?

A nomad is a person who has no fixed residence but move from place to place usually seasonally and within a well-defined territory.

The best and fastest way to make money trading is to have a low-frequency and low-risk strategy. If you’ve been following us for any length of time, you probably already know this, but in today’s lesson we want to expand on the concept of trading from anywhere. We will also explain why it pays to be able to trade as a side hustle rather than only relying on it.

Minimalism in trading:

We recommend and teach minimalism in trading, which means that trades should be executed in small quantities. These trades should be done with high conviction. One of the HUGE advantages of this approach is you can do anything else while still staying in touch with the markets and placing trades. You can travel, hold down multiple jobs, do side-hustles, anything you choose.

The purpose is to make trading a “complement” of your lifestyle, NOT its primary focus. Not only will this reduce your stress levels, but it will also benefit your trading account tremendously.

The scales of life must be balanced – and in life, as they say, moderation isn’t all that bad. So, trading needs to be in moderation, too. Most people lose at trading because they do not practice moderation. Instead, they watch the charts all night, becoming hooked on short-term charts and end up getting snared in the day-trading trap that captures so many people who are new to the market.

We hope that after reading this article, you will have adopted a different trading attitude and consider trading as a side gig that may or may not work out for you. MOST WEALTHY PEOPLE have multiple streams of revenue and do not put all their eggs into one basket. Thinking about it, it doesn’t make much sense to concentrate too much on trading, but to keep an eye on things.

The only way for most people to succeed in trading is to follow a similar path as we are about to unfold.

It’s NOT too good to be true to trade while traveling, while you’re at home, while you’re away on business for work, while you’re at a coffee shop, wherever you may be. You can literally trade from anywhere if you take this “trade from anywhere” approach. Here is how it is done.

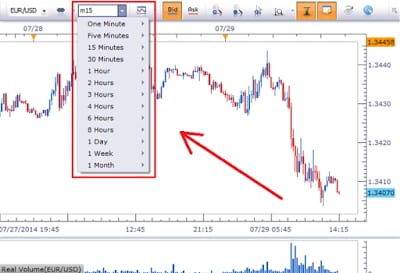

Focus on the right chart time frames

For a nomadic approach to trading, you need to analyze weekly, daily, and four-hour charts. Most other time frames are a waste of your time, in my opinion. If you don’t know why yet, please watch our video on the power of higher time frame trading.

If you trade higher time frames such as daily, you can simply check the charts each day, or even just once or twice a day before the New York trading day closes at the end of the day. This kind of trading is also called end of day trading, where you base your trading decisions on the previous day’s closing price. This allows you to filter out any noise or meaningless movement and allows you to do other activities at the same time.

Low-Frequency

If you are focusing the majority of your attention on the higher time frame charts, then obviously, you’ll trade less than if you were constantly watching the intraday charts. Taking a relaxed approach to trading and not being held to your computer around the clock is a good thing that lets you ENJOY your life rather than be tied to it all the time.

There is one very important benefit of low frequency trading, and that is BETTER for your overall performance and chances of long-term consistency than day trading or any other form of shorter-term, higher-frequency trading. Trades are meant to MAKE MONEY OVERALL, not to lose it

Let the market do it’s work

Traders sit in front of their computers for hours and have information overload constantly; they analyse, think, and analyse some more, which can make it feel like a never-ending process. Doing this is pointless and harmful. Trading can be just as addictive as gambling, drugs, or video games. As a result, your task is to self-control yourself, so that the market doesn’t control you

You need to take a step back and let the market do the work by analyzing the information. Constantly thinking or analyzing can elevate your stress levels and cause you to have an impaired trading state of mind. one that is not fit for expert and calculated trading, but one of volatile, frenzied, and capricious trading.

The main things we let the market do for us is to set and forget our trades. Resist the urge to continuously monitor them. Let it go until the next day or two, at which point you can come back to the market.

Less is more

You should stop over trading to see gradual improvement in your trading performance. The human brain is not engineered to be good at trading because we are not engineered to be good at self-control and regulation of impulses. When you’re watching a computer screen with numbers that fluctuate and the possibility of lots of profits, self-control goes right out the window. THIS IS WHY FEWER IS BETTER!

Core Points of Price Action Trading Strategy

Let’s discuss the main pieces of a trading strategy, so that you understand how it’s actually done

End of Day Trading:

This is probably the cornerstone of the nomad trading approach. The idea is that you’ll only be making trading decisions after the New York close each day, using only daily charts and considering only bars that have closed out. When you eliminate the higher time frames from your lower time frames, it means that there is less noise and confusion.

Set and Forget:

This strategy means When you find a trade and set up the parameters (entry, stop, position size, exit), you walk away from the computer until the next day after the New York close. It doesn’t make sense to stay in front of the chart all day trying to “figure out” what will happen. you cannot figure it out, so you have to trust your strategy and just do nothing most of the time.

Simple Trade Signals:

Simple price action signals are what we trade and teach our students; they are not difficult to learn. The indicators you see are just a confusing, overly-complicated and unnecessary waste of time. Technical indicators are simply derivatives of the price action anyway, so why not simply trade the price action.

Traders who don’t want to spend all day staring at charts instead of enjoying life should use a simple trading approach like this. Money management and psychology are the difficult parts of trading, so don’t make chart analysis and trading difficult as well.

Money Management:

One of the most valuable aspects of a “nomadic” and relaxed approach to trading is a good money management strategy. When you raise your risk to a point where you’re preoccupied with your trades, you’re not going to be able to set and forget your trades because you’ll be too worried about losing money. The risk per trade must be controlled so that it does not exceed your ability to handle it.

Conclusion:

After reading this article, you would have realized the benefits of trading like a nomad . Yes, it will take some getting used to; it may seem counterintuitive to trade less, to check your trades less, or to be on the computer less. Your trading performance will improve if you keep it up. Distracting yourself from the markets, using a simple strategy like the price action strategies and managing your risk are keys to success.

Get a hobby, travel, actually get a life, so you aren’t just sitting around doing nothing, which eventually causes you to open your computer and start overtrading.